Earn High , Live High With High Values.

Highest Value Research Private Limited is a leading consultancy firm dedicated to providing strategic guidance and comprehensive solutions to your businesses. With a team of experienced advisors and industry experts, we offer tailored strategies and innovative approaches to tackle complex challenges and drive sustainable growth.

What We Do?

The service we offer is specifically designed to meet your needs.

-

24/7 Support

We take pride in offering unparalleled support to our valued customers, ensuring that help is always just a call or message away, 24/7.

Learn More -

Trusted Partner

HVRPL is considered a trusted financial partner by Hundreds of Indian customers. It’s your time now.

Learn More -

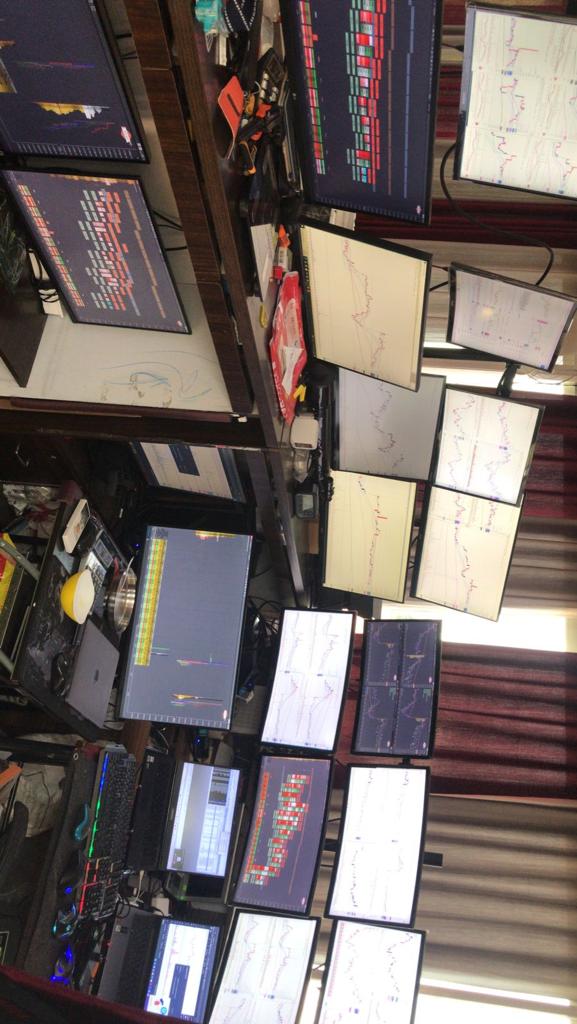

Daily Updates

We understand the significance of staying informed in the fast-paced world of trading. That's why we are dedicated to providing our valued clients with daily market updates that matter.

Learn More -

Market Research

In HVRPL we let you stay updated with market trends, industry developments, and changing customer preferences.

Learn More

Why Choose Us?

Elevating Lives, One Solution at a Time.

-

Adhering to trade laws, import/export regulations, and ethical practices in conducting business.

-

Embracing technological advancements and market changes to stay competitive.

Our Solutions

We take the stress out of your spending, providing you with perfect control and peace of mind.

At our core, we empower businesses to thrive in the digital era by guiding them through successful digital transformation journeys and achieving tangible growth. With a wealth of experience and deep contextual knowledge, we leverage an extensive ecosystem of expertise to deliver transformative solutions. By seamlessly blending our insights and capabilities, we equip our clients with the tools they need to excel in today's rapidly evolving digital landscape.

-

Range of Services

-

Client-Centric Focus

-

Innovative Solutions

-

Continuous Improvement

Latest Stories

Check out the latest news on trending topics !

-

"Nifty's July Rally: FIIs Shift Stance, August's Outlook Uncertain."

July saw an impressive 700-point rally in the Nifty, largely fueled by Foreign Institutional Investors (FIIs) entering the market with substantial investments. However, in the last two sessions, FIIs turned net sellers, raising questions about the sustainability of the momentum in August. Investors are closely monitoring the situation to understand how FIIs' actions will impact the market's trajectory in the upcoming month.

-

Capital goods stocks defy market weakness, surging on robust sector fundamentals.

The reason capital goods stocks defy market weakness and surge is due to their robust sector fundamentals, which include increased government spending on infrastructure projects and a positive outlook for economic recovery. These factors have boosted investor confidence and led to higher demand for capital goods stocks.

-

US Fed Decision Today: Is This the Final Hike in the Current Cycle? What Implications Might It Hold for the Indian Market?

US Fed's rate hike decision holds key implications for India's market. Final hike may boost confidence and attract investments, while hints of more hikes could trigger volatility and capital outflows from emerging markets. Investors closely monitor the outcome for potential impacts.